Why Are Oil and Natural Gas Prices Behaving so Similarly?

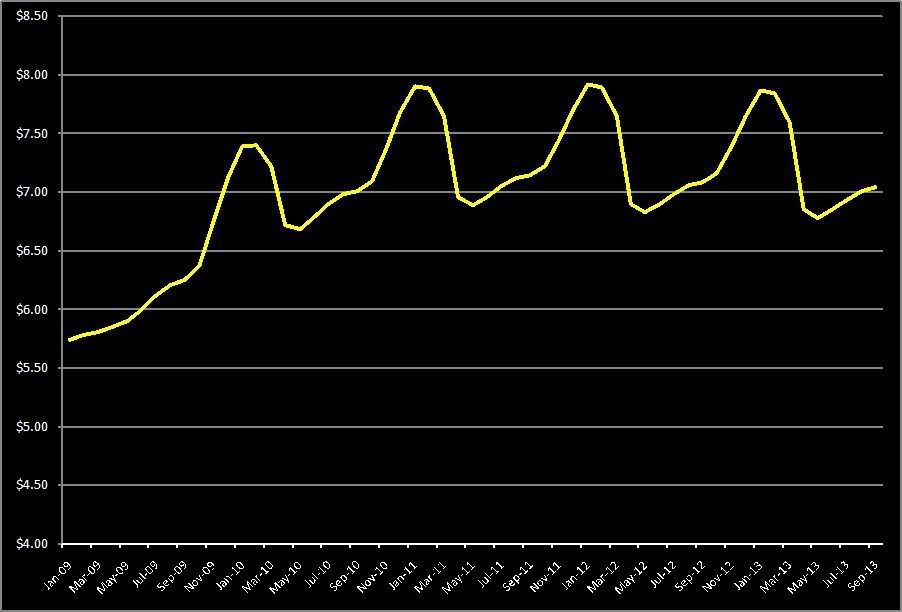

Now you can see here that futures contracts for winter months are higher than those for summer months (excluding winter 2009--we are in a seriously contango market for reasons I don't exactly understand).

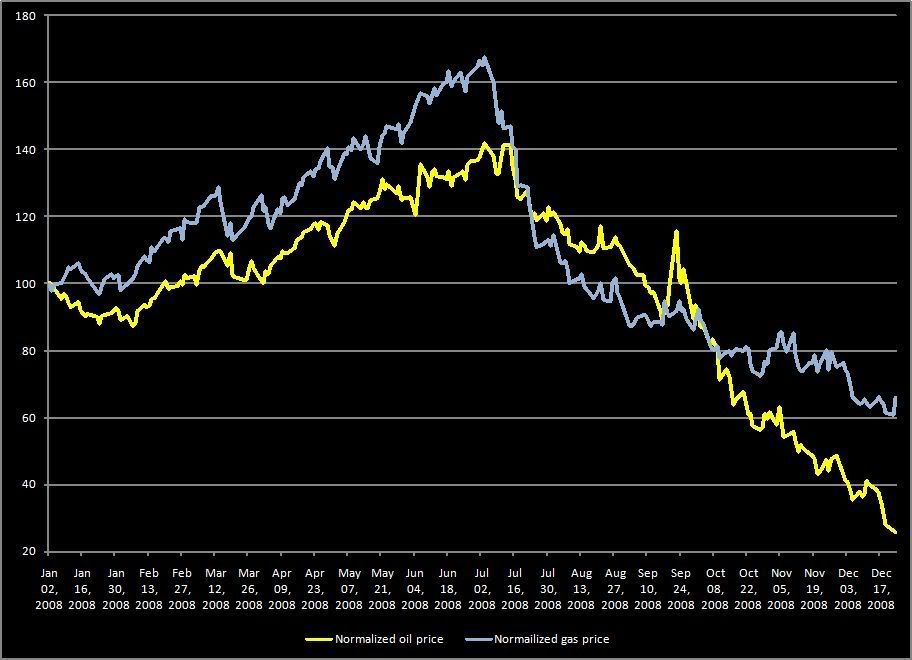

Nonetheless, over the past year, oil and gas prices have tracked pretty closely. The graph below normalized the price of spot WTI crude and near month gas futures so that they are both 100 on January 2, 2008.

So the question is, why did both commodities run up in the first half of the year and collapse in the second half? The explanations usually given for the collapse of oil is that 1) high gas prices forced people to drive less, and 2) the economy collapsed, which also limits demand for gasoline, jet fuel, etc. I don't know if I totally believe that (obviously demand is less, but that doesn't explain why oil got so expensive in the first place). There are some reasonable theories of financial shenanigans in oil in the first half of this year, as I have discussed in the past.

And it definitely doesn't explain the price of natural gas, either going up or down. Why should the two curves look so similar. The Houston Chronicle has an analytical article, where they talk to many of the usual suspects in this field (Pickering, Simmons).

Natural gas prices have fallen dramatically this year much like crude prices, but shrinking demand is only one culprit. The other is a gas glut from a boom in U.S. production."The industry is suffering from its own success in some respects," said Karr Ingham, head of Ingham Economic Reporting in Amarillo. "We’ve added a lot of natural gas production in Texas and elsewhere just because of high prices."

Those prices, which surpassed $13 per million British thermal units last summer, have fallen below $6 as U.S. production grew while demand decreased amid the recession in the second half of the year.

Producers are slashing capital budgets and idling rigs so they can drill within their means amid the credit crunch as well as reduce output.

But so far, production hasn’t slowed enough to compensate for oversupply. Output is on track to exceed 60 billion cubic feet per day next year — the highest in 35 years, Merrill Lynch analyst Francisco Blanch said in a note to investors.

This is not controversial--high gas prices, along with technological improvements, have permitted natural gas producers to exploit gas shales, which previously would have been too expensive to produce. The article observes the number of rigs dropping (drastically for the largest producer, Cheasapeake) as expensive fields become too costly to drill. The article's sources expect the rig count to drop dramatically.

But analysts say production still needs to contract further.

Blanch, the Merrill analyst, said the raft of announcements from producers to cut spending on drilling and leases doesn’t mean the cutbacks will be big or immediate. He said rigs will likely decline in the Rocky Mountains or the Midwest, but not necessarily in more highly producing areas like the Barnett.

"We expect more drilling announcements from producers," Blanch said.

Mason said this year’s gradual dropoff of rigs likely will burst into a "big unwind" in the first quarter of 2009, with rigs dropping by the dozens. However, a lot of that will be rig contracts at high-cost wells winding down with operators unwilling to re-sign them in the current price and economic climate.

But not all companies will react the same way, he said. The oil majors’ operations are consistent in any price environment. Independents, particularly those like Chesapeake that outspent their cash flow during the boom, are scaling back. But the small, private operators that fluctuate with seasons and price are expected to bolt in droves, Mason said.

At which point, production (which lags behind drilling somewhat) will start dropping enough to push prices up.

All this makes sense except for one thing--if the mechanisms driving oil prices and natural gas prices in the past few months have been so different (mostly demand on the oil side and mostly supply on the gas side), why are prices acting so similarly?

Labels: economics, natural gas, oil

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home